Introduction

April 2025 extended the multi-month decline in market volatility across all YieldMax ETFs, with implied volatility (IV30) reducing across the board. This trend reflects broader market sentiment, where risk appetite has returned amid improving US inflation data, a stabilizing labor market, and growing expectations of a Federal Reserve cut as early as June 2025.

That being said, a surprisingly strong April jobs report, showing an addition of 177,000 jobs and an unemployment rate holding steady at 4.2% has tempered expectations for an imminent rate cut. The robust labor market suggests that the Fed may delay easing monetary policy, which could influence option premiums and dividend yields in the coming months.

Despite this, the portfolio has generated $583.78 in net dividends for April. While this represents a slight decline from March, it underscores the resilience of the YieldMax strategy in a cooling volatility environment. As we move into May, careful balancing and strategic positioning will be key to navigating the evolving market landscape.

What Happened?

US Equity Market

The S&P 500 closed April at 5,515.72, down 10.2% from it's all time high of 6,144.15 set in Feb 2025. The market face broad-based pressure throughout the month, driven by 2 primary developments:

- The announcement of sweeping new US Tariffs in early April 2025, which reignited trade war concerns and triggered a swift market repricing.

- A VIX spike early April, it's highest level since the pandemic, reflecting heightened fear and demand for downside protection.

- A stabilizing end to the month, as investors digested a strong April jobs report, released late in the month, which reinforced the Fed's case to delay interest rate cuts, further cooling investor sentiment.

By April 30, the VIX had cooled, while still elevated, was well below it's early month panic high, signaling, fading volatility even as equity indices remained under pressure.

Cryptocurrency Market

Bitcoin's April trajectory was volatile but ultimately bullish. After dropping to $76,000 in early April, it then rebounded to end the month around $95,600. The recovery was supported by:

- The announcement of a US strategic Bitcoin reserve

- Renewed institutional interest

- Continued positioning of Bitcoin as a digital safe haven amid fiat uncertainty.

However, despite the bounce, BTC's post halving performance lagged behind historical cycles and crypto equities like MSTR and COIN remained under pressure.

Market Outlook

As we head into May 2025, markets face a delicate balancing act between cooling inflation, robust employment and geopolitical uncertainty. In spite of legitimate concerns about trade disruptions and delayed Fed action, the rapid VIX retracement also suggests that investors are not pricing in prolonged fear.

Portfolio Overview

Transactions and Options Overview

Total deployed in April 2025 : USD 3,245.79

Averaging into MSTY, anticipating IV recovery and capital appreciation potential as Bitcoin and MSTR sentiment rebuild. Average cost remains favorable relative to long term bullish expectations for MicroStrategy and Crypto in general.

Portfolio Breakdown

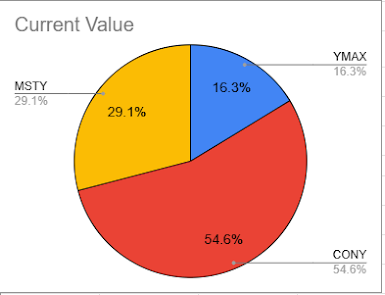

The portfolio closed April with a total market value of USD 18,194, down from the total invested capital of $20,771.37, reflecting a net unrealized loss of - USD 2,577.37 (-12.41%). This decline was primarily driven by price depreciation in CONY and YMAX, while MSTY remained the portfolio's relative outperformer.

The portfolio remains heavily weighted in MSTY (76%) as we build towards a 1,000 share position. While unrealized losses in CONY and YMAX weigh in on the total return, dividend income has softened the drawdown. May's strategy will focus on defensive dividend compounding and volatility re-entry timing.

Lessons from April

- A high VIX doesn't guarantee high YieldMax premiums - IV30 is the primary income driver

- Bitcoin's price recovery did not lift MSTY premiums - Direction does not equate Volatility

Project Implications and Strategic Adjustments

- Total returns remain positive, despite a -USD 2,577.37 unrealized loss, thanks to $2,625 in dividends and USD 178 in option premiums resulting in a net gain of USD 226 (+1.09%) on invested capital.

- Dividend income has proven resilient, softening the impact of price depreciation in CONY and YMAX. This validates the income-buffer strategy in volatile conditions.

- Option income contribution remains minor (6.8% of income) due to falling IVs. This highlights the portfolio's dependence on dividends, particularly from MSTY to sustain returns

Strategic Adjustments for May

- MSTY accumulation will continue cautiously

MSTY remains the portfolio's most stable performer and is supported by MSTR's recovery. Further additions are viable below US 25, provided IV remains above 40. To watch for consolidation in MSTR above US 400 before deploying larger tranches.

- No addition to CONY and YMAX for now

Both remain in capital decline with shrinking IV due to pressure from COIN and tech-linked softness respectively.

- Deploy options strategically during IV spikes

Favor short duration cash secured puts or covered calls only when IV pops above 50 particularly around:

- April CPI (Release May 13)

- Federal Reserve Events / Macroeconomic Data release.

- Crypto related market catalysts

Conclusion

The MSTR rebound in April justifies continued confidence in MSTY, but low IV across the board calls for more precision and less passive compounding. May strategy will lean into tactical accumulation, option spikes and watchful re-entry into underperformers only if volatility returns.

📬 Help Improve This Blog

To make this blog more comprehensive, I'm currently seeking:

💬 Reader feedback on option strategies or ETF income ideas

📈 Requests for visual charts (bar/line graphs of dividends or drawdowns)

📊 Suggestions for additional diversification ETFs or hedging tools

🧮 Any interest in backtesting or rolling yield projections for CONY/MSTY/YMAX

If there’s anything you’d like to see added, or have specific questions about income ETFs or option strategies, feel free to reach out or drop a comment!