Introduction

Welcome to a new segment on my blog, where I will be shining a spotlight on YieldMax ETFs. These funds combine traditional equity exposure with options-based strategies, aiming to deliver income opportunities to investors in search of steady yields.

It is my hope that this section will provide deeper insight and performance updates which will help you to decide if YieldMax ETFs might be a valuable addition to your portfolio.

My first transaction involved a small purchase in CONY (Coin Option Income ETF) on 23rd Oct 2024 which was followed closely by a 2nd purchase a week later.

That month saw a dividend of $2.02 a share which after a 30% witholding tax was still a whooping 9.93% dividend yield on cost.

Seeing the potential of significantly increasing my monthly cashflow as well as considering the first mover advantage of coinbase / bitcoin, I decided to look further into 3 funds (CONY, MSTY and YMAX) to see if I could further increase my yield.

Portfolio Summary (As of 31 Jan 2025)

Since that day, I have been slowly purchasing shares in the counters below and have accrued the following amounts at the following costs.

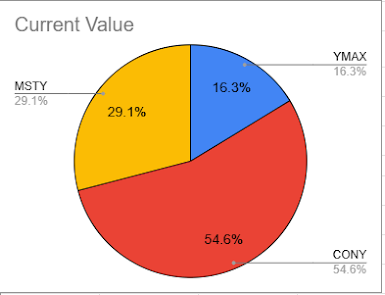

Portfolio Value

We can see from above that the current portfolio is still heavily skewed towards CONY. Based on the current expectations that Bitcoin will continue to climb in the year of 2025, I have decided to slowly balance my portfolio towards a 50% MSTY, 30% CONY and 20% YMAX ratio.

Transactions made in the month of Jan 2025

We can see here that several purchases of MSTY were made in the month of January towards that end, which brings my total MSTY holdings to 110 shares.

Portfolio Performance

As shown above, for the month of January, the total portfolio cost has since increased to approximately USD $11,000 and has yielded a dividend of approximately USD $683 (or 6.16% of the portfolio cost). However, due to a depreciation in prices, only CONY is shown to still be positive.

The reasoning for such a depreciation in prices could be as follows:

- Federal Reserves Monetary Policy

Interest Rate Decisions in late 2024, the federal Reserve implemented a series of interest rate cuts (a total of one percentage point) to stimulate economic activity. However, in January 2025, the Fed opted to pause further rate reductions, citing persistent inflation concerns and economic uncertainties. This pause signaled a cautious approach, which might have affected investor sentiment and led to market volatility.

Despite previous rate cuts, inflation still remained elevated at the end of 2024. This combination of strong economic growth and a tight labor market contributed to sustained price increases, which resulted in eroding purchasing power and heightened concerns about future economic stability.

The re-election of Donald Trump as POTUS introduced significant policy shifts, including rapid deregulation and proposed changes to federal spending. These actions created further uncertainty into an already shaken market, as investors grappled with the potential impacts on various sectors and the broader economy.

In January 2025, the emergence of DeepSeek, a competitor to OpenAI's ChatGPT, led to a sharp decline in tech stocks. Notably Nvidia experienced a significant loss in market value. This event contributed to the broader market volatility, impacting ETFs with tech sector exposure as questions on the efficiency of current AI models as well as the future demand for AI software.

Dividend Performance

The above shows the dividends collected as 2025 and how it was distributed on a monthly basis. In spite of only starting last October, we are already approaching our first target of US $500 a month for the year of 2025 (US $405.68 in the month of January alone).

We notice that CONY has been trending downwards over the past 3 months due to reasons highlighted above. However, we do foresee it going back up with the current recovery trend of the underlying stock COIN (Coinbase Global Inc).

As this was the first month receiving dividends from MSTY, we are unable to confidently predict a trend. That being said, we noted that the underlying stock MSTR (Microstrategy Inc) has been stuck in consolidation parallel to Bitcoin and this is unlikely to change.

Finally for YMAX, as this counter pays out dividends on a weekly basis, we saw a peak of US $0.245 per share on 30 Dec 2024, likely due to the additional days due to the Christmas period. If we look on a monthly basis, we also notice that there has been a slight increase in the monthly accrued dividends from US $0.744 to US $0.751. As YMAX covers a range of Option Income Strategy Funds such as BABA, NFLIX, AAPL, META and PLTR. It still remains to be seen how the impact of DeepSeek as mentioned earlier will have an impact on the dividend payouts.

Moving forward, I will continue to add to this portfolio of ETFs while also monitoring the rate of returns on this portfolio as we move towards the end goal of being able to comfortably afford an Omakase meal on a monthly basis.

If you have any queries, feel free to reach me and I will try to respond as soon as possible.

As mentioned in an earlier post, I still believe there is significant upside to cryptocurrencies as such, I am looking forward to holding on to these shares until at least end 2025 to 1Q 2026.

howdy. would like to put a lump sum to Msty as within the next 4 years, with Trump and Michael Slayor supporting Btc, it indirectly gear towards Msty. The intention is to provide a comfortable monthly dividend income until initial investments covered. Whats your take on it?

ReplyDelete