Omakase Six

Thursday, 13 February 2025

DBS Drops Big Dividends and a New Capital Return Plan - Here’s Why I’m Excited

Sunday, 2 February 2025

Bitcoin Plunges to $91K Today: A Closer Look at the Events Behind the Drop

Bitcoin falls 10% intraday

- New trade tariffs announced by Trump have created uncertainty in global markets prompting investors to shift towards safe-haven assets.

Bloomberg reported a surge in US Dollar and a forecast for falling stock markets amid these trade tensions, DXY data also confirms that the dollar's strength has increased after the confirmation of the tariffs on Friday.

- Canada, China and Mexico's retaliatory tariffs to further escalate trade tensions

In response to the US Tariffs, China and Mexico have indicated that they would retaliate, and Canada announced counter tariffs, targeting approximately C$ 155 billion US goods which is expected to further strain the long standing trade relations between the 2 nations.

This combined effect has led to a significant strengthening of the US dollar relative to other currencies and as a result, impacted Bitcoin in several ways.

- Risk-off sentiment

When geopolitical or trade tensions rise, investors tend to shift their funds into safer assets. This can lead to the selling of what is considered "riskier" investments including the likes of Bitcoin. Although Bitcoin has sometimes been viewed as a hedge, its volatility also means that in times of uncertainty, investor might choose more traditional safe havens such as gold, putting downward pressure on Bitcoin's price.

- Stronger US Dollar

A stronger US dollar makes assets priced in dollars more attractive, As Bitcoin is currently pegged to US stable coins (namely USDC and USDT) which is priced in US dollars, when the dollar surges, the appeal of Bitcoin to global investors fall, as they see more value in holding cash or dollar-denominated assets rather than a volatile crypto asset. This can contribute to lower demand and a further drop in Bitcoin prices.

- Increased Market Volatility

The trade tensions and subsequent policy reactions contributed to a broader market uncertainty which can further lead to increase volatility across various asset classes. With many investors and algorithms set to trigger sell orders in turbulent markets, Bitcoin could face rapid sell-offs or liquidations as part of this wider market correction.

All these have created a perfect storm for Bitcoin's 10% plunge today. That being said, at the point of writing, crypto has been known to be subject to knee jerk reactions and as such, this decline may represent a temporary adjustment amid broader economic uncertainty. We will need to watch closely to see if Bitcoin can stabilize or will be subject to larger volatility as the situation develops.

Friday, 31 January 2025

Omakase - Kamii Sushi

The Journey Begins

Review

The price of the FUYU set is RM 538++ (Approx SGD $190)

Thursday, 30 January 2025

Summary Jan 2025 (YMAX, MSTY, CONY)

Introduction

Welcome to a new segment on my blog, where I will be shining a spotlight on YieldMax ETFs. These funds combine traditional equity exposure with options-based strategies, aiming to deliver income opportunities to investors in search of steady yields.

It is my hope that this section will provide deeper insight and performance updates which will help you to decide if YieldMax ETFs might be a valuable addition to your portfolio.

My first transaction involved a small purchase in CONY (Coin Option Income ETF) on 23rd Oct 2024 which was followed closely by a 2nd purchase a week later.

That month saw a dividend of $2.02 a share which after a 30% witholding tax was still a whooping 9.93% dividend yield on cost.

Seeing the potential of significantly increasing my monthly cashflow as well as considering the first mover advantage of coinbase / bitcoin, I decided to look further into 3 funds (CONY, MSTY and YMAX) to see if I could further increase my yield.

Since that day, I have been slowly purchasing shares in the counters below and have accrued the following amounts at the following costs.

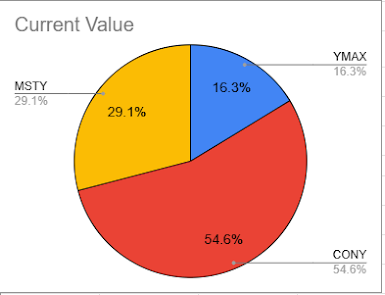

We can see from above that the current portfolio is still heavily skewed towards CONY. Based on the current expectations that Bitcoin will continue to climb in the year of 2025, I have decided to slowly balance my portfolio towards a 50% MSTY, 30% CONY and 20% YMAX ratio.

- Federal Reserves Monetary Policy

Interest Rate Decisions in late 2024, the federal Reserve implemented a series of interest rate cuts (a total of one percentage point) to stimulate economic activity. However, in January 2025, the Fed opted to pause further rate reductions, citing persistent inflation concerns and economic uncertainties. This pause signaled a cautious approach, which might have affected investor sentiment and led to market volatility.

- Inflationary Pressure

- Policy Uncertainty

- Tech Sector Turbulence

Dividend Performance

As mentioned in an earlier post, I still believe there is significant upside to cryptocurrencies as such, I am looking forward to holding on to these shares until at least end 2025 to 1Q 2026.

Wednesday, 29 January 2025

Option Income Strategy ETFs: A Quick Guide for You

What is an Option Income Strategy ETF?

An Option Income Strategy ETF is a special type of exchange-traded fund that generates income by using options. Instead of just holding stocks and hoping they go up, these ETFs sell options contracts to bring in extra cash, which they then pay out to investors as dividends (often monthly).